SPEAKERS

SPEAKERS

Ready to become a business superhero? Let's dive into some simple, actionable strategies to future-proof your business!

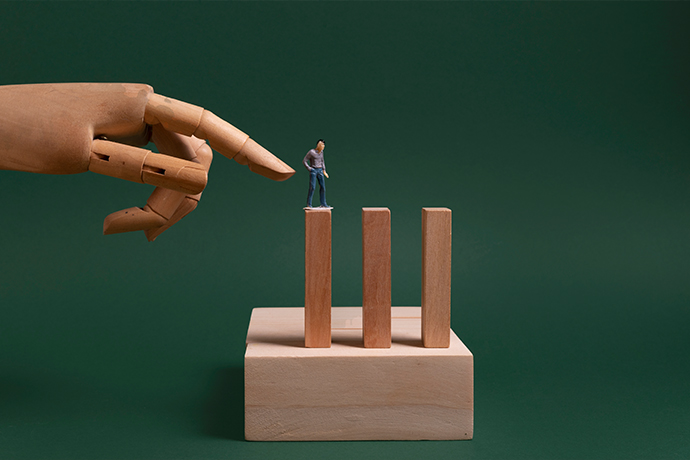

Let's face it, when times get tough and competition is fierce, figuring out the best moves for your company and team can feel like juggling flaming chainsaws, right? Sticking to what you know is safe, but have you considered the power of a well-timed side hustle?

It could be the secret weapon that boosts your main business and keeps your brand fresh! Think of it as a double win – more cash flow and staying top-of-mind with your customers. What do you say? Up for the challenge?

So why exactly is future-proofing business such a good idea? Allow us to simplify it for you!

Tech is here to stay. So why not make it your friend? Using modern technology can help your company become more flexible, efficient and adapt to business resilience.

Feeling swamped by repetitive tasks? Yeah, been there! But guess what? There's this awesome thing called automation, basically like a robot helper for your work. Imagine software taking care of all that boring stuff – accounting, keeping track of inventory, even customer service chats!

The best part? It frees up your team to focus on the cool, creative stuff, the things that actually make a difference. Now, with all that more free time, what would YOU do? Think conquering that project you've been putting off, or maybe finally mastering that killer coffee recipe for the office? Let's talk about how automation can boost your productivity!

Hold on, are you missing out on the online world? Today, having a strong presence online is kind of a big deal. Think of it like having a cool storefront in the digital mall! Investing in a good website is like having a shiny, inviting shop window.

Social media is your way to chat with customers, share fun stuff, and keep them coming back for more. You could even offer online sales, like a virtual lemonade stand! This whole online thing opens up a ton of new ways to make money and stay connected with the people who love your stuff.

I am sure "Don't put all your eggs in one basket" is a phrase you've come across many times. Well, it turns out that's super good advice for your money too!

Ever put all your chips on one number at the roulette table? Feels kinda nerve-wracking, right? That's what investing with all your money in one place is like. Just like you wouldn't bet everything on black, spreading out your investments (we call it diversifying) is way smarter.

By spreading your money over many assets, you are essentially establishing a safety net. That way, if one investment struggles, the others can help keep things in check. Diversifying – it's like having a financial superhero squad protecting your future!

Hold on, don't ditch your whole business plan just yet! Instead, think about what else you could bring to the table that complements what you already do. Like, if you're the king (or queen) of cupcakes, maybe you could offer fun baking classes to share your magic touch. It's all about finding ways to expand without straying too far from what you do best!

Feeling stuck selling to the same ol' crowd? There are tons of potential customers out there just waiting to discover your incredible product or service. Think about it – maybe there's a different age group you could target or a whole new city that would love what you offer.

The trick here is to do your due diligence. Learn all you can about these new markets before you jump in, that way you can tailor your approach and make a real splash!

Keeping your finances in check is crucial. Healthy finances mean the future of business will be well handled.

Life throws curveballs, right? It's the same for businesses too. Stuff happens, like a sudden drop in sales or maybe a grumpy customer leaves a bad review. But here's the thing: you can't exactly dodge those rainy days.

So, what if you were like a superhero and had a secret stash – a financial safety net? Consider it like rainy-day savings, just for your company. Having enough cash saved to cover you for a few months (3 months is a good rule of thumb!) can be a lifesaver.

Imagine the peace of mind! No more scrambling to pay the bills or stressing out your awesome employees. This little nest egg can keep your business afloat when times get tough, giving you time to weather the storm and come out even stronger!

Debt can be useful in an emergency, but it can quickly spiral out of control if not handled carefully. So the key is to avoid going overboard with borrowing. Like, that new phone can wait, trust me.

Do you have an existing debt and want financial stability? Concentrating on paying it off is the best course of action. Think of it like cleaning out your mental clutter – the faster you tackle it, the lighter you'll feel, financially speaking!

The term investing is something you will often come across in a business venture. However, investing can be done for a number of reasons. So, why not invest in your biggest asset (your employees)? This is that one goal that will pay off in many ways.

Training helps you see where everyone shines and where they might need a little extra coaching to unlock their full potential. It's all about building a super-strong team, and working together to achieve amazing things!

Your workforce can remain skilled and more capable of handling new tasks with the support of training. It also improves loyalty and morale. Happy workers produce more and stick around longer.

Thinking about future-proofing your business against economic uncertainty? Life's not just about surviving, right? We all wanna thrive, and live life to the fullest! So how do we do that? It's all about embracing the new tech and making the most of what's out there!

Have you given it any about diversifying your offerings? It's a great way to stay ahead. Keeping your finances in check is crucial, too. And don't forget to stay adaptable—things can change fast!

Your company has a promising future if you make thoughtful plans and take aggressive measures.